BizBuySell’s Second Quarter 2014 Insight Report reveals transactions were just 3% short of record mark set in Q2 2008; year-to-date transactions on pace for biggest year since Report inception

San Francisco, CA – July 7, 2014 — BizBuySell, the Internet’s largest business-for-sale marketplace, recently reported that second quarter 2014 small business transactions reached the highest levels reported since before the recession hit in mid-2008.

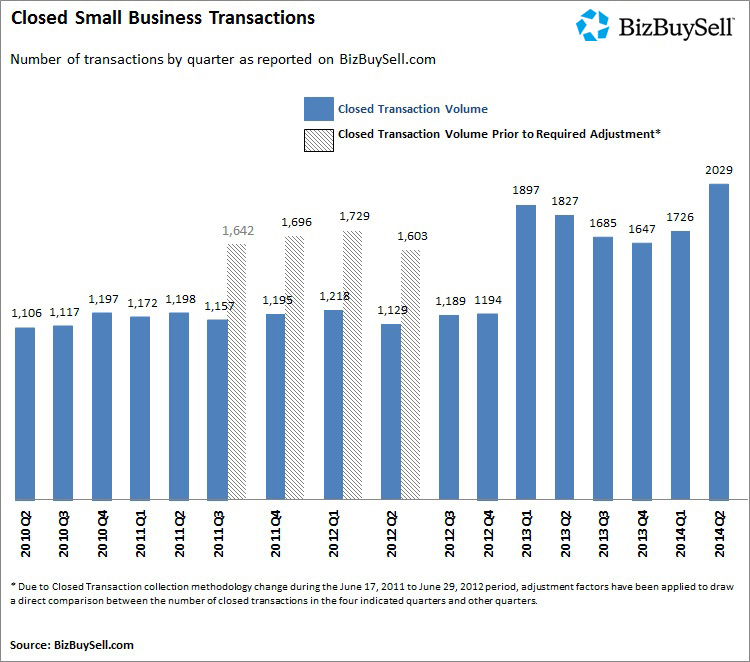

The 2,029 reported transactions in Q2 2014 represent the second highest total recorded since BizBuySell.com began tracking insights data in 2007, just 3 percent behind the record-high 2,098 transactions reported in Q2 of 2008. The full results are included in BizBuySell.com’s Q2 2014 Insights Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

Even after a strong 2013, the business-for-sale market continues to grow as the reported deals in Q2 represent an 11 percent increase from the same period last year and 18 percent growth over the first quarter of 2014. The quarter-over-quarter growth is the highest since Q1 of last year, when the current six quarter trend of higher transaction activity began. The continued growth can be linked to a variety of factors, most notably increased supply and demand, improving small business performance, and increased capital availability.

“It has been an exciting year and a half for the small business transaction market and so far it has shown no signs of slowing down,” Bob House, General Manager of BizBuySell.com, said. “To see brokers reporting this much activity is a great sign that we have left the Great Recession behind and both buyers and sellers are confident they can close deals in today’s small business market.”

Small Businesses Getting Healthier, Supply Continues to Drive Market

The improving financial performance of small businesses is a key contributor to rising transaction levels. Both the median asking and median sale price for small businesses rose in Q2 2014, assisted by the owner’s ability to show higher revenue and cash flow numbers. Most impressively, the median cash flow of small businesses sold during the quarter spiked nearly 8 percent from $93,000 in Q2 2013 to $100,000 in Q2 2014. The median revenue also increased from $393,700 to $400,060.

At the same time, the average revenue multiple of sold businesses jumped 8 percent, from 0.58 to 0.63, while the average cash flow multiple remained stable at 2.23. Compared to longer-term historical multiples, these numbers indicate that it remains a buyer’s market. Demand is certainly strong, as evident from the number of transactions, but the historically low financial multiples mean that buyers are receiving excellent value on their purchasing dollar. Eventually, this trend will reverse and multiples will rise as pent-up supply works through the market, but, given the sixteen quarters of depressed activity during the recession, it may be some time before this occurs.

Strong Start to 2014 Bodes Well for Future

The 3,755 reported year-to-date transactions represent a slight increase from the 3,724 reported in the first half of 2013, but it does quell concerns that 2013 was an outlier. The fact that small business transactions rose 49 percent in 2013 and are still climbing in 2014 is one of the many reasons optimism continues to grow within the business-for-sale market.

In a recent BizBuySell survey, brokers expressed similar sentiment and expected the growth trend to continue throughout 2014. In fact, more than 70 percent of national business brokers believed more small-business deals would get done over the remainder of 2014 than have already closed in the first half of the year. Among the reasons cited for optimism were seller price expectations becoming more realistic (27 percent), a continued improvement of the small-business environment (20 percent), an increase in the number of buyers (19 percent) and an increase in the number of sellers (18 percent).

“The latest quarterly data reflected what we heard at the International Business Brokerage Association (IBBA) Conference in early June: the business-for-sale market is in great shape,” House said. “Barring unforeseen factors, we expect the brisk transaction pace to continue for the second half of 2014. If that happens, 2014 will set a new high-water mark for transaction activity in a single year since we began tracking this activity in 2007.”