“With many of the uncertainties of 2012 behind us, the outlook for the business-for-sale market may be improving.”

.BizBuySell has released its latest economic data for the fourth quarter of 2012 and for the full-year 2012. The company’s data tracks trends in the sales of small business-for-sale and the latest data shows that closed transactions spiked significantly in the final three weeks of 2012 as the Fiscal Cliff deadline approached and higher taxes loomed. The results are based on aggregate business-for-sale transactions reported by participating business brokers nationwide.

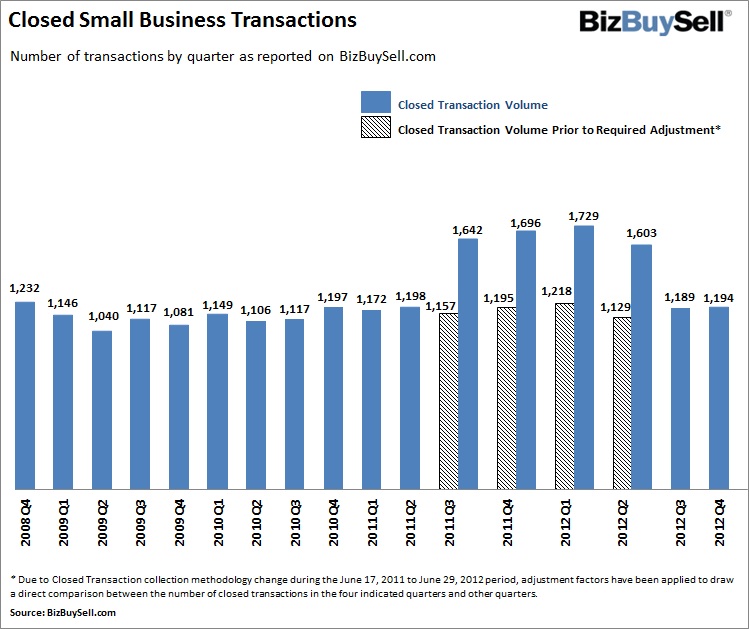

While the quarter started out slowly relative to Q4 2011, due to uncertainty regarding the U.S. Presidential election and pending Fiscal Cliff, the number of closed small business transactions spiked up 43.4 percent in the final three weeks of December as compared to the same period in the prior year.

The rush to get transactions completed in the waning weeks of 2012 was markedly different from 2011’s holiday and end-of-year-period, when the rate of small business transactions experienced a typical year-end slowdown. That year, business-for-sale transactions slowed 15.6 percent in the last three weeks of the fourth quarter compared to the first ten weeks of the quarter. In contrast, in 2012, the number of transactions increased 27.8 percent compared with the first ten weeks of the quarter, resulting in the over 43.4 percent increase over typical end of fourth quarter transactions. The results are included in BizBuySell.com’s Fourth Quarter 2012 Insight Report, which aggregates business-for-sale transactions reported by participating business brokers nationwide.

“The dramatic bump in closed transactions over the final three weeks of 2012 really shows the effect that tax policy can have on business owners’ motivation. Given the eight plus months it typically takes to sell a business, the end of year increase comes from owners who put their business on the market months ago pushing to ink deals before the New Year,” Curtis Kroeker, General Manager of BizBuySell.com said. “As concern rose that a fiscal deal wouldn’t be reached or that a deal would still include tax hikes, sellers clearly felt vulnerable to higher taxes in 2013.”

Total Fourth Quarter, Year-Over-Year Transaction Volume Flat

Despite the marked increase in small business transactions late in the year, the number of business exit transactions in Q4 and 2012 overall stayed roughly even with reported 2011 transactions. In the fourth quarter of 2012 brokers reported 1,194 closed small business transactions to BizBuySell.com, a single transaction less than the 1,195 reported in Q4 2011. The full year of 2012 showed a similar trend, albeit up slightly with brokers reporting 5,689 closed transactions, a 0.2 percent increase over last year.

In general, the business-for-sale marketplace has experienced gradual, yet bumpy improvement since business-for-sale transactions bottomed out in Q2 of 2009. BizBuySell.com attributes the lackluster results for 2012 to market uncertainty as both buyers and sellers cautiously awaited results of the Presidential Election and the fiscal cliff negotiations. Business brokers expressed those concerns in a November BizBuySell.com outlook survey, in which the national debt and the inability of politicians to reach a fiscal cliff deal was voted the number one factor most endangering economic recovery. “Tax rates” was the third most common answer.

“With the election, fiscal cliff and new tax rates all up in the air throughout most of 2012, buyers and sellers perceived a higher degree of risk in the market,” Kroeker said. “That uncertainty slowed the usual year-over-year growth in small business transactions and left the business-for-sale market essentially flat.”

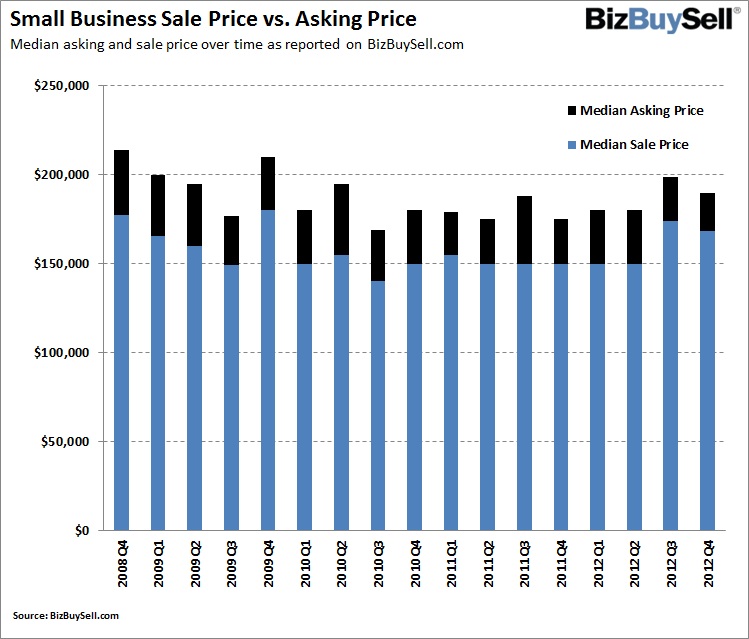

Healthy Businesses Available for Low Prices

The trend of improving small business financials did continue in 2012, laying a foundation for a more robust business-for-sale market in 2013. The median cash flow of for-sale businesses in 2012 was $88,902, a 4.6 percent increase from the $85,000 recorded in 2011. As small businesses grew healthier over the year, median asking and sale prices also rose. According to the Insights Report, the median asking price for a small business in 2012 was $185,000, a 2.8% increase over 2011’s median of $180,000. The median sale price also rose 3.2% to $160,000 from $155,000.

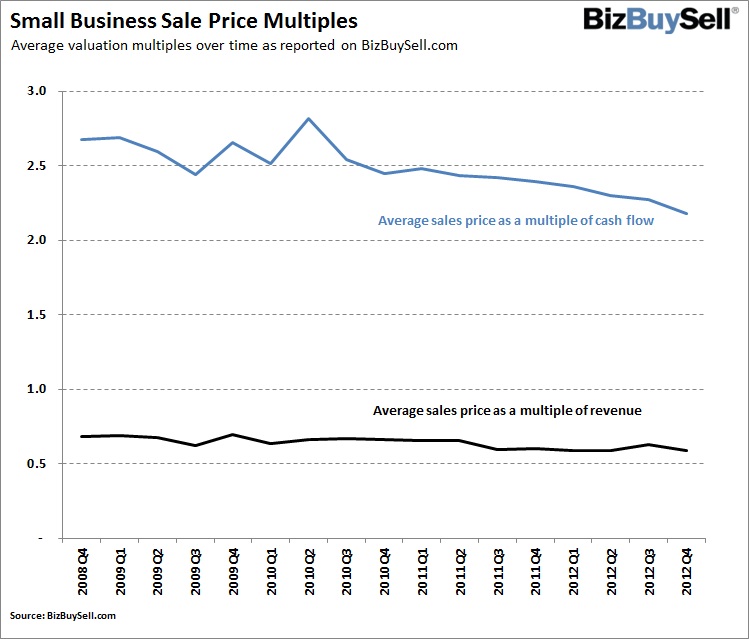

With cash flow growing at a faster rate than asking prices and sale prices, the data continue to show this is a good time to be a buyer. Healthier small businesses are selling at prices that remain near historical lows since BizBuySell.com started reporting business-for-sale metrics in 2007.

“We’ve seen small business financials improve consistently for a few years now, yet buyers aren’t yet flocking to the market,” Kroeker said. “With more owners finally planning their exits, this results in a buyer’s market keeping sales multiples low. Accordingly, brokers have indicated that it’s more important than ever for sellers to provide seller financing to get deals done.”

Gradual Growth Expected to Return In 2013

A Presidential election and fiscal crises aren’t going to do the small business economy any favors. With many of the uncertainties of 2012 behind us, the outlook for the business-for-sale market may be improving. Now that the tax picture for 2013 is clearer, many small business owners will be more comfortable creating an exit plan. And with business financials on a slow, but steady improvement path since late 2010, the trend seen in recent years of gradually increasing transaction volume should continue in 2013.

“Considering the uncertainty of the election and fiscal cliff, the fact that small business transactions matched the 2011 numbers is a positive sign,” Kroeker said. “As we enter a new year, sellers who had been awaiting answers to these long-outstanding questions may be ready to pull the trigger, spurring a return to the slow and somewhat bumpy business-for-sale growth that our data has shown since mid-2009.”