BizBuySell’s Q1 2013 Insight Report shows 56% jump in business-for-sale transactions as compared to same time in 2012; Sales prices reach two-year high.

![]() BizBuySell has released its latest economic data for the first quarter of 2013. The company’s data tracks trends in the sales of small business-for-sale and the latest data shows that closed transactions spiked significantly in the first quarter of the year when compared with the same period last year. The results are based on aggregate business-for-sale transactions reported by participating business brokers nationwide.

BizBuySell has released its latest economic data for the first quarter of 2013. The company’s data tracks trends in the sales of small business-for-sale and the latest data shows that closed transactions spiked significantly in the first quarter of the year when compared with the same period last year. The results are based on aggregate business-for-sale transactions reported by participating business brokers nationwide.

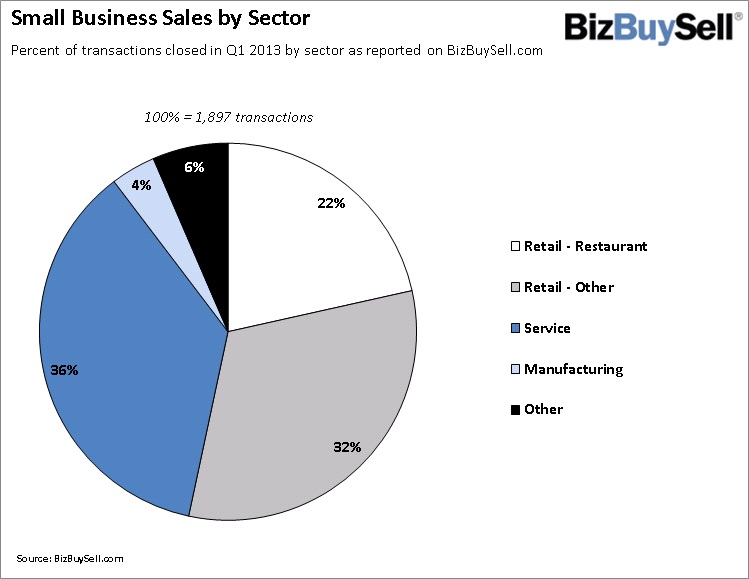

In total, 1,897 closed transactions were reported in Q1 2013, a dramatic bump over the 1,218 recorded in the same period of 2012. The number represents the highest number of businesses sold in a quarter since the second quarter of 2008. The 56% year-over-year jump is also the largest such increase since small business sales bottomed out in mid-2008. The results are included in BizBuySell.com’s First Quarter 2013 Insight Report, which aggregates business-for-sale transactions reported by participating business brokers nationwide.

The spike in small business sales can be attributed to a number of factors.

For a few years now, small businesses financials have been improving as the economy slowly recovers. Business owners who have been looking to exit their business, particularly baby boomers ready to retire, finally have their businesses in sellable shape and are more confident that they will receive an appropriate financial return on their sale. This proved true in the first quarter of 2013 as the median sale price of a sold business was $180,000, the highest level since 2009.

Business transaction fundamentals are strong with a latent supply of owners ready to sell and improving buyer demand due to ongoing unemployment, recovering stock portfolios and the slowly improving lending situation. Just last month a BizBuySell.com survey of national business brokers found that 75.2 percent of respondents said they are seeing the same or more deals getting done as compared to 2012. When asked about the number one factor causing the increase, the top two answers were the increase in the number of interested buyers and the increase in the number of owners looking to sell.

In addition to strengthening business results and fundamentals, other factors are also contributing to the strong year-over-year growth. At the end of 2012, small business transactions rose dramatically as owners rushed to complete the sale of their businesses before the potential Fiscal Cliff and new tax rates. BizBuySell.com data showed that over the final three weeks of December, small business sales climbed 43.4 percent over the same period in 2011. It is likely that many additional such deals carried over to the first quarter of 2013. Brokers last month echoed this sentiment as survey respondents attributed the 2013 increase to a backlog of transactions spurred by the Fiscal Cliff that didn’t get done in 2012 and are closing now.

“Since the economic downturn in 2008, we’ve been waiting for a time when buyers and sellers finally felt ready to re-enter the business-for-sale market,” Curtis Kroeker, Group General Manager of BizBuySell.com and BizQuest.com, said. “The continued strengthening of business performance, the resolution of the uncertainty of both the Presidential election and (to a large degree) the Fiscal Cliff, and the strong stock market appear to be creating such an environment.”

Small Business Financials Improving

As the stock market and overall economy have improved, so have the financials of small businesses across the country. According to the Insight data, the median cash flow of a small business sold in Q1 reached $100,000, a 20.45 percent increase over Q1 of 2012. Median revenue also improved, jumping from $360,000 in Q1 2012 to $401,213 in Q1 2013, an 11.45 percent increase.

The improved financial health of small businesses is enabling sellers to ask for more money from buyers. The median asking price for businesses sold in the first quarter was $199,000, a 10.6 percent increase over Q1 2012. Encouragingly, the median sale price rose even more (20 percent year-over-year) in Q1 2013 to $180,000 – a level not seen since Q4 2009.

“Small business financial indicators have been on the rise for some time now and with many of the metrics reaching levels not seen since the 2008/2009 downturn, there is little doubt the improved health is helping push the jump in small business exit transactions,” Kroeker said. “Hopefully this trend continues increasing owner confidence that they can get a good sale price and buyers excitement to join an improving small business market.”

Outlook for 2013

While the large jump in small business transactions is a great sign for the future, there is still some uncertainty regarding the remainder of 2013. Business brokers were cautiously optimistic in the BizBuySell.com survey last month, with 54.2 percent of brokers expecting slight to significant improvement going forward. Another 13.4 percent expected no change from the current activity level. When asked what factor is most endangering economic recovery, 31.8 percent cited the national debt and ongoing political gridlock. Small business and personal tax rates came in second, cited by 17.5 percent of respondents, while both small business health care costs and ongoing long-term unemployment received 12.3 percent of votes each.

The next few quarters of 2013 will be very telling regarding the status of the business-for-sale market. The resolution of the Presidential election and fear of the pending Fiscal Cliff appear to have accelerated business-for-sale transactions at the end of 2012 and the beginning of 2013. If improving business fundamentals and improved access to capital also played a significant role, activity levels will likely stay high in the second quarter. Decreased activity in the second quarter would suggest that the spike in activity was temporary and largely related to the carryover transactions driven by concerns about the Fiscal Cliff at the end of 2012.

“A number of factors appeared to have fueled a spike in business sales this quarter,” Kroeker said. “We expect small business health to continue to improve. However, time will tell if it will result in high transaction volumes for the rest of the year or if the market will return to the slow, but steady road to recovery we saw in 2012.”

APPENDIX: Additional Statistics from Small Business Transactions Reported to BizBuySell

Thanks for specialits in custom research paper writing for help with this article!