BizBuySell is reporting that small business merger & acquisition transactions rose 6% in the first quarter of 2015. Businesses n the services sector drove the increase.

Here is the text of BizBuySell’s report.

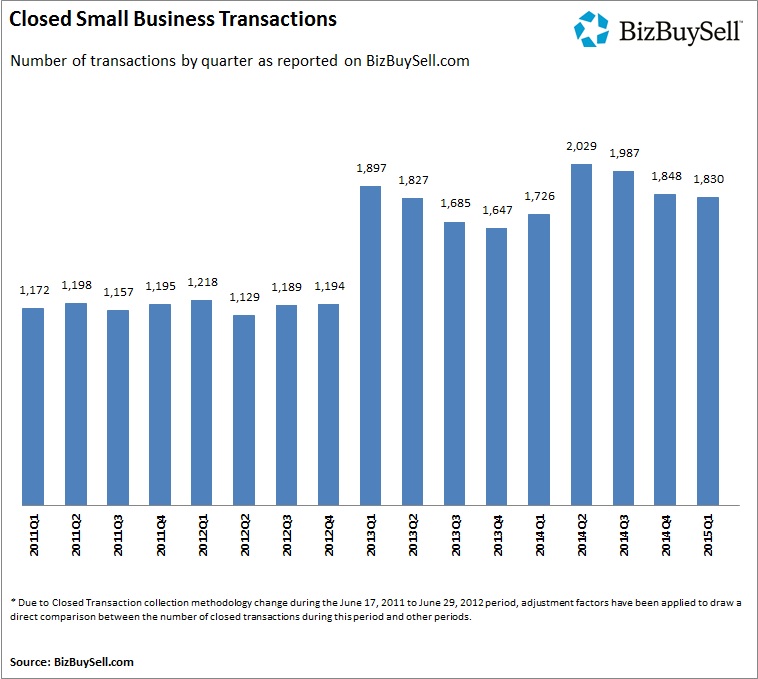

San Francisco, CA – BizBuySell the Internet’s largest business-for-sale marketplace, reported that small business transactions continued at a strong pace in the first quarter of 2015, growing 6 percent from the first quarter of 2014. A total of 1,830 small businesses were reported sold in Q1, continuing a two-year trend of exceptionally robust activity in the business-for-sale market. The full results are included in BizBuySell.com’s Q1 2015 Insight Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

Recent surveys of buyers, sellers and business brokers attribute the transaction increase to the growth of both supply and demand in the business-for-sale market. Baby Boomers continue to supply the market with quality listings as they reach retirement age and buyers (who now have access to more lending options) are pulling the trigger on their small business ownership plans.

A key reason buyers and sellers are entering the market in larger numbers is the improving health of small businesses in general. Financial indicators remained high in the first quarter of 2015, giving sellers hope that they can earn a high sales price and giving buyers optimism about the future of their potential acquisitions. The median revenue of small businesses sold in Q1 stood at $442,000, up from an even $400,000 at the same time last year. Median cash flow hit $104,000, which represents the highest median cash flow reported since BizBuySell.com started tracking this data in 2007.

Impressive financial performance is allowing sellers to ask for and receive higher prices for their businesses. The median asking price of a small business in Q1 was $225,000, a significant jump from the $199,000 median asking price recorded a year ago. The median sale price in Q1 2015 was $200,000, a marked increase from the $175,000 median sale price in Q1 2014-and a price that is consistent with the higher sale prices seen in the final quarter of 2014.

“We continue to see sustained growth in the business-for-sale market,” Bob House, Group General Manager of BizBuySell.com and BizQuest.com, said. “It’s now been more than two years of consistent financial improvement and we continue to reach new milestones each quarter. It’s great to see that small business owners can grow and successfully sell in today’s environment.”

Service and Retail Businesses Drive Growth of Transactions, Financial Performance

Businesses in the service industry appear to have fueled transaction growth in Q1. The 711 service industry transactions recorded in Q1 2015 represent an 18 percent increase over Q1 2014. Broken down geographically, small businesses in the service sector were most popular in the Midwest region, where total transactions grew 63 percent from Q1 2014. Service industry sales were also up 35 percent in the Mountain region and 17 percent in the South.

Small businesses that specialize in retail sales saw the biggest gains in financial performance in early 2015. The median revenue of a retail business sold in Q1 of 2015 was $537,500, up from $437,783 in Q1 2014. Median cash flow for businesses in the retail sector grew from $89,907 to $99,355. Improved performance indicators also gave retail owners confidence to ask for and receive more for their businesses. The median asking price for retail businesses grew from $199,000 in the first quarter of 2014 to $220,000 in the first quarter of 2015, resulting in a significant increase in the median sale price, from $155,000 to $197,250.

Strong Revenue and Cash Flow Indicate Improving Small Business Environment in 2015

Transaction activity has been consistently strong since the beginning of 2013, but the financial performance of small businesses has been particularly robust in recent months. The median revenue of small businesses sold on BizBuySell.com spiked in mid-2014 and has remained strong since, hovering just below $450,000. At the same time, median cash flow has reached all-time highs in each of the last two quarters, peaking at $104,000 in Q1 2015.

Likewise, sales price multiples for both median revenue and median cash flow are trending upwards. The median revenue multiple for sold businesses in early 2015 was 0.63, up from 0.59 at the same time last year. The median cash flow multiple also grew slightly from 2.21 in Q1 2014 to 2.27 in Q1 2015. These increases point to a more balanced market, where both buyers and sellers receive value from transactions. The current, balanced market is expected to continue to drive interested buyers and sellers to the table throughout the remainder of 2015.

“We’ve heard from our broker customers that they are seeing more qualified buyers capable of taking over the reins from sellers, specifically Baby Boomers ready to retire,” House said. “Supply and demand fundamentals, combined with the improving financial performance of small businesses in general, should drive growth through the rest of the year.”