Move Your Multiple: Improve Cash Flow and Decrease Working Capital Requirements

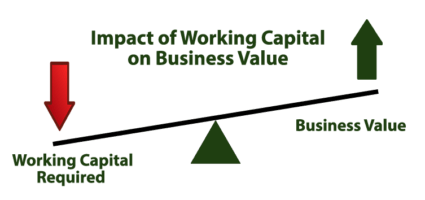

Everybody knows that a company’s revenue and profits play a big role in its value. After all, a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization) is one way to estimate the value a business. However, valuation is not nearly as simple as that. One way to improve your multiple and increase the value of your business is to improve cash flow and decrease working capital requirements. This steps will also make your business stronger regardless if when or if you plan to sell it. Cash vs. Profits Cash flow is different than profits in that it measures the cash coming … Read more