According to BizBuySell.com, the number of closed business-for-sale transactions reported in Q3 2011 rose 3.5% year over year, fueled by lower business valuations.

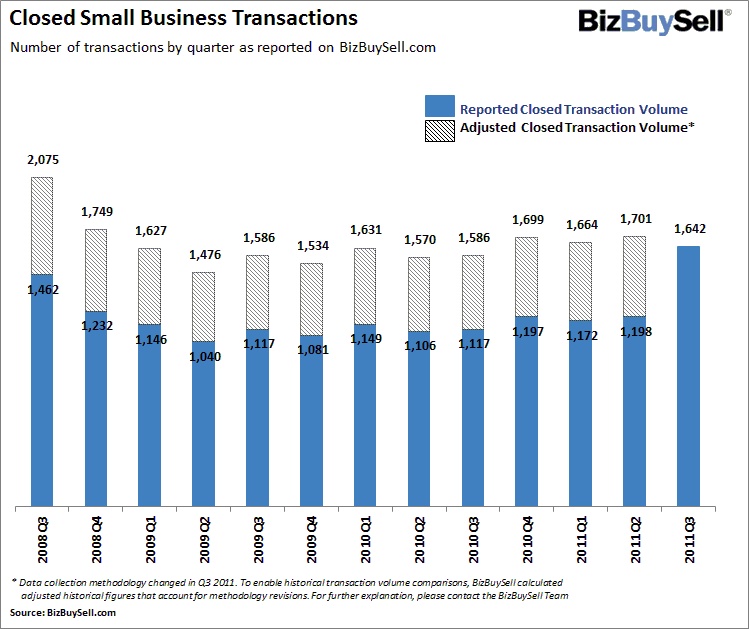

San Francisco, CA – October 3, 2011 — BizBuySell.com, the Internet’s largest marketplace for buying or selling a small business, today released its Third Quarter 2011 Insight Report on business succession trends. The report, which aggregates business-for-sale transaction data provided by participating business brokers, shows slight improvement in business succession activity, as closed transactions increased 3.5 percent from 1,586 in Q3 of 2010 to 1,642 in Q3 of 2011.* This number is down slightly from the 8% year-over-year increase reported in Q2 of 2011.

“We’re glad to see the year-over-year upward trend that we’ve been reporting in the business-for-sale market continue into Q3,” said Mike Handelsman, Group General Manager, BizBuySell.com and BizQuest.com. “However, there’s no denying that Q3 was somewhat turbulent for the overall economy, so it’s not a surprise that we are down slightly versus last quarter.”

Sold Businesses Reporting Lower Valuations

While closed transactions showed a slight increase over Q3 of 2010, the average multiple of annual revenue that a small business sold for on BizBuySell.com was 0.60, a decrease of 10.9% versus the same quarter a year ago. The average multiple of annual cash flow that a business sold for was 2.42, a decrease of 4.7% vs. the same quarter a year ago. According to Handelsman, this decrease in valuation multiples is likely a result of sellers becoming more realistic about their asking and selling prices.

“The trend toward more realistic expectations regarding valuations is a primary driver of the increase in closed transactions,” said Handelsman. “Business owners who may have been holding out for an economic recovery or waiting for their business to recover are now opting instead to exit their businesses, even if that means accepting a lower sale price.”

Larger Businesses Selling in Q3 than Previous Quarters

Notably, BizBuySell.com is seeing an increase in the average size of sold businesses, with the median sale price for Q3 reported at $150,000, up 7.1% vs. a year ago. Handelsman notes that this increase in sale price is likely the result of a combination of two factors – changes in both financing and valuations.

“As valuations decline, buyers are able to purchase larger businesses than in previous quarters for the same purchase price,” Handelsman explains. “Also, as the lending environment improves and financing slowly becomes more available for business buyers, they are able to buy slightly larger businesses.”

BizBuySell expects the current slight but steady upward trend to continue through the remainder of 2011 and into 2012 as the lending environment continues to improve.

“We’re seeing more attention being paid to business funding though both government programs and legislation, which will help to drive more closed small business transactions,” Handelsman said.

About the BizBuySell.com Insight Report

BizBuySell.com is the Internet’s largest marketplace for buying or selling a small business. The company releases its BizBuySell.com Insight Report on a quarterly basis, reporting changes in closed transaction rates, valuation multiples and other economic indicators for the small business transaction market. Closed transactions are reported to BizBuySell.com by business brokers nationwide.