The pace of industry consolidation in the landscape services industry is hard to evaluate. Private equity and similar investors have “found” the landscape services sector and are searching for good candidates for acquisition.

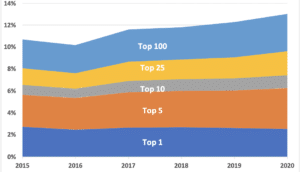

Here is a chart that illustrates the pace of landscape industry consolidation:

Investors are attracted to landscape services for several reasons. The most important include the high level of recurring revenues, a high level of fragmentation within the industry and landscape industry’s character as an “essential service”, which has been clearly illustrated during the COVID-19 pandemic.

It is clear that the only reason there have not been many more transactions is that there are a limited number of candidates for acquisition with enough scale to merit investment as a private equity platform.

In order to evaluate the pacer of consolidation within the industry, we used the Lawn & Landscape 100 and compared the revenues of the L&L 100 to estimated total industry revenues. This analysis suggests that industry concentration within the top 100 firms has moved from about 10% to about 12% over the past five years.

There are several important caveats to this analysis:

1. The L&L 100 is a voluntary process and many firms choose not to participate.

2. Acquisitions only show up in the revenues of acquirors from the date of acquisition on. As a result, an acquisition made in 2020 will not fully show up in the acquiror’s revenues until 2021.

3. There are various other oddities in the L&L 100 affecting the calculation, including a few acquired companies remaining in the L&L 100 and the inclusion of system-wide revenues for franchisors.

However, these do not obscure the trends. The landscaping industry is consolidating, especially when fully factoring in acquisitions made in 2020 and 2021. The percentage of industry revenues accounted for by the Top 100 may be in the range of 14%.

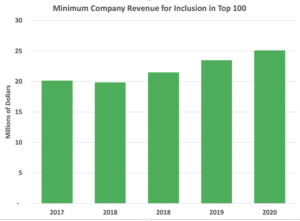

However, as larger companies are acquired, new companies are started every day. It is interesting to note that the size of the minimum company in the Top 100 has risen over the past five years at about the rate of industry growth.

There continue to be good opportunities for smaller companies in the industry – and will be fresh opportunities for acquisitions as well.

There continue to be good opportunities for smaller companies in the industry – and will be fresh opportunities for acquisitions as well.