To our clients & friends:

Meet Us at the NALP Leader’s Forum

Building Value in Your Business

Move Your Multiple: Improve Cash Flow and Decrease Working Capital Requirements

Most business owners understand that a company’s revenue and profits play a big role in its value. After all, a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization) is one way to estimate the value a business. However, valuation is not nearly as simple as that.

Most business owners understand that a company’s revenue and profits play a big role in its value. After all, a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization) is one way to estimate the value a business. However, valuation is not nearly as simple as that.

But since you charged upfront, you get all $10,000 of cash on the day your customer decides to buy. This positive cash flow cycle improves your company’s valuation because when it comes time to sell your business, the buyer will have to write two checks: one to you, the owner, and a second to your company to fund its working capital – the cash your company needs to fund its immediate obligations like payroll, rent, etc.

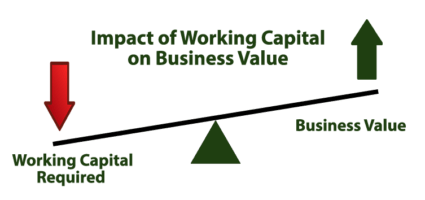

The trick is that both checks are drawn from the same bank account. Therefore, the less the acquirer has to inject into your business to fund its working capital, the more money it has to pay you for your company.

The inverse is also true.

If your company consumes cash, an acquirer is going to calculate that it needs to inject working capital into your business on closing day, which will deplete its resources and lessen the check it writes to you.

Recent Transactions

The Principium Group

The Principium Group provides advisory services related to mergers & acquisitions and exit planning to lawn, landscape, and facilities services businesses. Our professionals have assisted business owners in hundreds of transactions. For buyers, Principium provides assistance and counsel in strategic planning, identifying potential acquisition targets, due diligence and planning for successful integration of acquisitions. For sellers, Principium provides assistance and counsel in evaluating strategic alternatives, identifying and negotiating with potential acquirers and assisting with transactions from due diligence through the closing process. In order to provide the highest quality service, we maintain relationships with other professionals serving the green industry and can access those professionals to supplement our internal resources. No matter how large or small your business may be, we have the resources to serve you well. We understand that the decision to buy or sell your business is a profound one, and we pledge to work with you in a professional and confidential manner while we help you navigate this often confusing process. Whether you have immediate plans to buy or sell a business or may sometime in the future as part of an exit planning strategy, we would welcome the opportunity to talk with you about your business.

The Principium Group

P.O. Box 414

Cordova, TN 38088

901-351-1510

Ron Edmonds

901-351-1510

[email protected]

LinkedIn

Chris Martin

BRE #01966513, LICENSED IN CALIFORNIA

888-229-5740, ext 103

[email protected]

Notice: